The time is now for omnichannel retail: 2021 consumer trends

It is no surprise that the coronavirus pandemic massively boosted online retail sales in the US. Shoppers turned to online shopping as well as less conventional channels such as click-and-collect and curbside delivery to meet their shopping needs while conforming with social distancing norms.

A year and a half into the pandemic, it looks like it is far from over, and some of these trends are here to stay. We conducted a survey of 1,200 US shoppers to understand their shopping habits this year. What we found are some interesting demographic trends – men and women of different age groups preferred particular channels for unique reasons. In addition, we also noticed that they were likely to shop for different product categories online and had varied concerns about online vs in-store shopping.

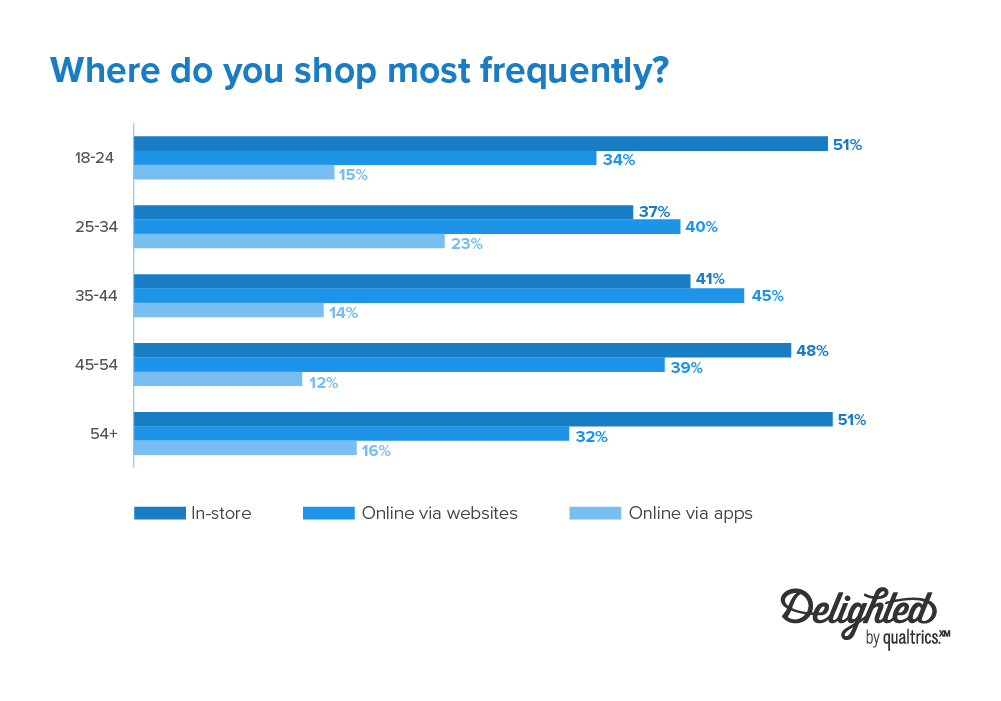

For instance, we found that unlike what one would assume, more than half (51%) of 18–24 year olds stated that they preferred shopping in-store, while 25–44 year olds mostly preferred to shop online. Their reasons for preferring in-store shopping were not very different from those of other age groups: the desire to touch-and-feel items before buying them (78%; 75% across all age groups), the instant gratification of taking items home immediately (51%; 62% across age groups), and an appreciation of the in-store shopping experience (44%; 46% across age groups).

By far, household essentials were the more preferred items to shop in-store (83%), with most women over the age of 54 years preferring to shop for essentials in stores (93%). In contrast, the group least likely to shop for essentials in store were young men (62%). When it comes to buying essentials online, more men in the 25–34 years (71%) and 35–44 years age groups (75%) reported doing so compared to other groups.

Fashion and clothing was the other category that saw both high in-store traffic (69%), especially among women who were in the 25–34 year (80%) and 45–54 year (85%) age groups. Meanwhile, in the case of online fashion, more men in the 18–24 years age group (70%) and women in the 45–54 years age group (74%) reported that they preferred shopping for fashion, clothing, and accessories online.

When it comes to reasons for staying out of stores, more men reported being concerned about COVID-19 (71%) compared to women (54%). Further, only 33% of young women in the 18–24 age group reported that COVID-19 related health concerns adversely affected their in-store experience, compared to 76% of young men. Other concerns across all demographics groups were the availability of products (50%) and long lines at checkout counters (47%).

When we look at the “pull” factors for online shopping, convenience of placing an order (70%) tops the list, even ahead of reduced risk of contracting COVID-19 (66%) and delivery (56%). In addition, while men appreciated the faster service of online shopping (52%), women valued the opportunity to browse, reporting that the lack of sales pressure (40%) was a big draw.

However, there is still much room for improvement in users’ experience of online shopping. Product quality issues (58%), lack of certainty about the product’s suitability or fit (41%), and data privacy (41%) were the chief concerns. Interestingly, men were far more concerned about data privacy (45%) and security (41%) issues compared to women (34% and 24%, respectively).

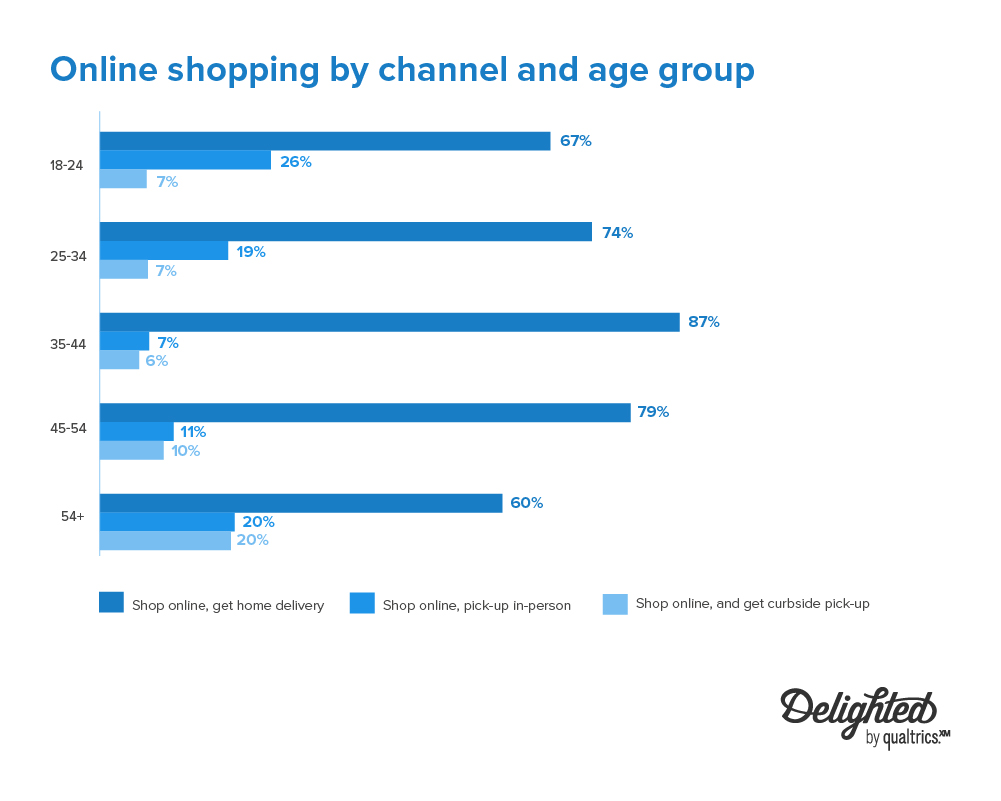

Finally, with respect to alternative delivery channels, while home delivery is still the most preferred option (79%), we found that in-person pick-up is rather popular across age groups, with 26% of 18–24 year olds and 20% of 54+ year old preferring in-person pick-up. Curbside pick-up appears to appeal more to older shoppers, with 20% of 54+ year olds reporting that they preferred this channel.

What we found through our survey is that though there has been a significant shift to online shopping because of the pandemic, consumers prefer to shop in-store for specific products, such as household essentials and fashion. In addition, different demographic groups may have strong preferences regarding what they shop for where, indicating a need for brands to take a data-driven approach to understanding consumer preferences. Reaching customers where they are, either on social media or the high street, will make all the difference.

For the full report visit https://delighted.com/blog/omnichannel-retail-consumer-trends

How to Use AI-Powered SEO Tools for WordPress eCommerce

SEO is a critical factor in the success of any e-commerce WordPress store. As competition…

0 Comments11 Minutes

Why Short-Form Videos Are the Future of Content Marketing

Your Instagram customers spend over 50% of their time watching short-form videos and reels. Rather…

0 Comments12 Minutes

The Role of Digital Marketing in Business Growth

Online marketing touches every aspect of a business, whether it is initiating the idea or for an…

0 Comments3 Minutes

AI Meets Authenticity: Balancing Automation and Human Touch in Content Marketing

Is your brand starting to sound like a robot? In a world where algorithms write faster than any…

0 Comments8 Minutes

Essential Tools for Enhancing Web Design and UX Hosting

Have you ever visited a website that felt slow, clunky, or confusing? A website that is poorly…

0 Comments11 Minutes

How a Mini Cart Transformed My Store’s Shopping Experience

Okay, real talk—running an online store is hard. You think you’ve got everything figured out, you…

0 Comments9 Minutes

Balancing Your Security Initiatives With Industry Compliance Requirements

Managing a business today comes with a number of daily battles that need to be fought. Resources…

0 Comments11 Minutes

Best plugins to enhance the customer shopping experience

Customer experience is a key part of every online store. A good experience helps customers find…

0 Comments7 Minutes