Protecting Your Fintech Biz: 5 Essential Cybersecurity Tips

Building a secure FinTech app can be a tough nut to crack, especially if your development team lacks the know-how of FinTech security requirements.

Quick Links

It can result in your project exceeding its budget. Or worse extend its timeline.

But, no worries, we’ve got your back.

To tackle this challenge, you need to implement smart cybersecurity policies and approaches to building a highly secure financial platform.

Read On…

Why Cybersecurity is Vital in Fintech?

Cybercriminals love to target financial service providers these days, especially those in the Fintech industry. Unlike traditional banks, Fintech startups might not have enough security regulations in place, which makes their solutions easier to breach. Plus, this can result in additional security costs.

But wait, there is a solution.

Fintech companies can protect themselves by using proactive cybersecurity measures, like penetration testing. And since email is so important for financial services (think transaction notifications, authentication, etc), it’s crucial to have secure email protocols in place. This way, customers will trust your products and services even more.

To sum it up, a solid cybersecurity program with the right policies and measures is a must for Fintech businesses. It’ll help protect your customers’ sensitive financial info and keep you ahead of the game.

Current FinTech Risks and Challenges

Cybersecurity is a crucial aspect that your fintech firm can’t afford to ignore. When building your FinTech product, you’ll encounter several security obstacles. These include:

1. Identity management

Seamless data sharing is a critical feature of FinTech. However, financial organizations accumulate vast amounts of data, leading to concerns around data ownership and digital identity management.

There are compliance issues that arise if data deletion mechanisms are not implemented, particularly for client information after a subscription cancellation.

Moreover, there is a risk of data theft if appropriate data deletion measures are not in place.

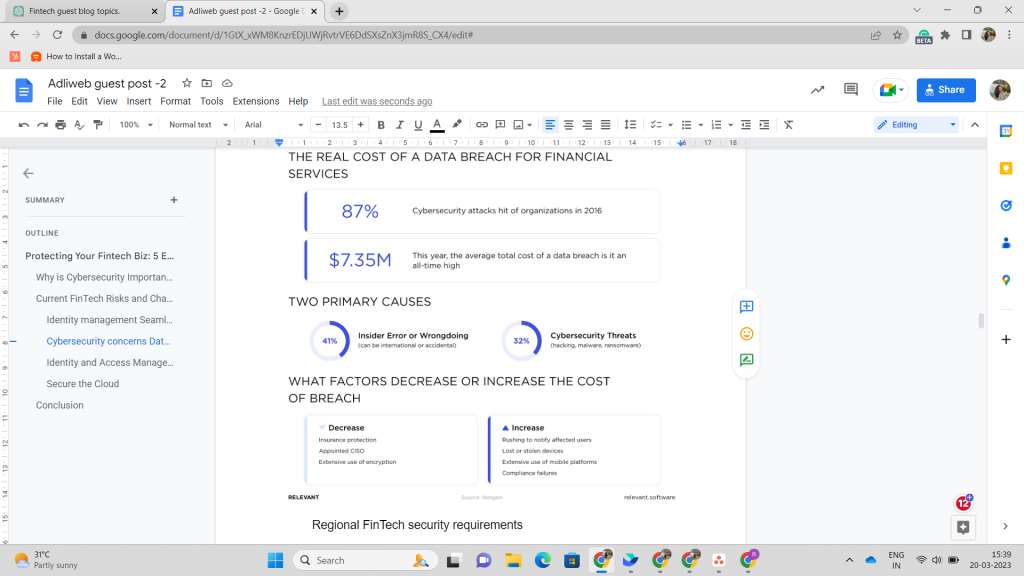

2. Cybersecurity concerns

According to the Annual Bank Survey, data security in FinTech is the primary concern for 70% of banks. The Ponemon Institute’s 2019 study also indicates that capital market firms and banks spend around $18.5 million annually to combat cybercrime. Additionally, the cost of hacker attacks for financial service providers is up to $18.3 million per year.

So, what happens then?

These providers collect a ton of personal information – like your finances, contact details, and even health data – and hackers are all about exploiting any weak spots.

And that’s not good, because they can use it for all kinds of shady activities like stealing money or identity.

The worst part? Most companies don’t even know they’ve been hacked until it’s too late.

- 3. Regional FinTech security requirements

To comply with KYC (Know Your Customer) practices and regional data protection regulations, fintech applications must adhere to guidelines.- For instance, if a company provides financial services to European Union citizens, it must abide by the GDPR (General Data Protection Regulation).

- Similarly, if a FinTech application processes information about Japanese residents, it should comply with APPI (Act on the Protection of Personal Information).

- But here’s the catch: local privacy laws can restrict the amount of data that FinTech software can gather and analyze. And to make things even more complicated, different countries have different interpretations of the same regulatory concepts.

- Not being aware of these regulations can lead to losing out on potential markets. So, building a secure FinTech application requires not only practical tools but also knowledge of local regulations to ensure compliance with regulatory requirements.

Here are 5 tips for fintech to keep their data and money safe:

1. Take help Of blockchain systems

Blockchain technology is not just used in digital marketing. This tech eliminates the need for central servers that can be targeted and hacked, as they function similarly to traditional bank vaults that store valuables in one secure location.

Hence, Fintech firms can utilize blockchain systems that are decentralized by design. These systems employ a network of computers, public and private security keys, and cryptographic requirements for every transaction to enhance security measures.

2. Private cloud storage

Cloud storage has become a ubiquitous tool for consumers, often utilized for archiving images and large files. However, in the Fintech industry, the amount of stored data is substantial, and security requirements are of utmost importance.

As a result, Fintech companies need to develop their private cloud to enhance access control or even multiple clouds to establish layered access and security.

3. AI and machine learning

Fintech companies need to utilize ML and AI to efficiently analyze large amounts of data and detect unauthorized users. Identifying authorized ones through their behavioural patterns is also crucial.

AI provides a reliable and scalable way for Fintech companies to detect fraud and identify vulnerabilities in their systems.

4. Regulatory technologies (regtech)

Regulatory technology (Regtech) solutions are specifically designed to ensure adherence to laws and standards, particularly concerning encryption and data privacy. For Fintechs, reg tech serves as a crucial tool to establish standardized safeguards.

To promote growth while safeguarding valuable assets, Fintechs must first identify and prioritize their most valuable assets. Practising cybersecurity hygiene is also crucial, such as frequently changing passwords and regularly updating security measures.

Pro Tip: A defence-in-depth approach is recommended, which involves combining multiple security controls to monitor, detect, and counter cyber-attacks. With a layered security structure, if one layer of protection fails, the other defences remain intact.

5. Focus on identity and access management

Enhancing system access security can significantly improve cybersecurity for fintech. To achieve this, access to sensitive data should only be allowed for employees based on their roles and responsibilities.

Implementing an Identity and Access Management system, such as AI technology for online document verification, can effectively address these challenges by eliminating illegitimate documents, preventing unauthorized access, and combating fraudulent activities.

Some Extra Measures

As technology advances, so do the tactics of hackers targeting the fintech industry.

Following the tips mentioned earlier can enhance cybersecurity and safeguard financial data. Additionally, consider the following suggestions for extra caution :

- Secure the Cloud

Cloud computing is widely used in fintech applications but can also expose businesses to risks. Although cloud-based services are convenient, they can also compromise sensitive data, making it vulnerable to cyberattacks.

To mitigate this risk, businesses need to establish a robust cloud security strategy to protect against current and future threats and ensure the safety of their company and customers.

- Apply Secure Coding Practices

Don’t let the need for rapid development and innovation overshadow a secure development methodology.

Formalized processes might feel like a drag at times, but they can help reduce the risk of security issues, whether they’re accidental or intentional. Things like independent review and testing, logical access, and segregation of duties can all make a difference.

Moreover, security should not be limited to the code alone, but the overall product design must be taken into account. That’s why integrating security into the product from the initial stage is crucial, rather than adding it as an afterthought.

It’s also a good idea to get a penetration tester to check your product for any weaknesses. They may potentially devise innovative methods to target the product that you might not have previously anticipated.

So don’t overlook that step!

- APIs Need Attention

Many fintech utilises application programming interfaces (APIs) to integrate with customer systems. The greater the level of access to these APIs, the greater the impact any weakness would have.

Any vulnerability related to customer data access or monetary transactions could be catastrophic.

Make note: Be aware that many fintechs have very old legacy systems on their backend that could create unexpected complications with any integration. Open APIs should be thoroughly tested via coding design and live penetration testing before moving to production.

- Use Cloud Providers For Your Vendor Due Diligence

If you’re working with banks, especially for bulk vendor payments, they’re gonna want to make sure that your cloud provider is secure too. So it’s a good idea to check out your cloud provider and see what kind of security certifications they have.

You might want to look at their SOC reports or certifications from organizations like the Cloud Security Alliance. It is recommended to conduct thorough research to demonstrate to banking customers that all operations are transparent and legitimate.

Pro Tip: Keep in mind that many controls in a cloud environment are still your responsibility as the user. The government has a Cloud Controls Matrix that will guide you in assessing all relevant controls surrounding the cloud implementation.

Final Word

Fintech and banks could make great partners.

But sometimes, they don’t always see eye to eye when it comes to security measures. That’s why it’s important to be ready for the security and risk management requirements of the banking industry to avoid any unexpected issues.

Additionally, it’s super important to educate and communicate openly with your employees about security measures. If you give your staff the right cybersecurity training on how to respond during a security breach, it can make a big difference in minimizing any damage that might be caused.

So make sure to keep those communication lines open!

Happy Financing!

Author Picture

Author Bio

Ramitha Ramesh is the editor at Karbon Business, renowned for her expertise in SEO content marketing strategy for a diverse clientele across the US, UK, and India. With a penchant for exploring the fast-paced realm of finance, business, and banking, her blog is a treasure trove of insights that offer unique perspectives on the latest trends and developments in the industry. Finding nirvana in food, fun and travel, she is on a mission to counter the infodemic amidst digital chaos.

LinkedIn Link:

Essential Tools for Enhancing Web Design and UX Hosting

Have you ever visited a website that felt slow, clunky, or confusing? A website that is poorly…

0 Comments11 Minutes

How a Mini Cart Transformed My Store’s Shopping Experience

Okay, real talk—running an online store is hard. You think you’ve got everything figured out, you…

0 Comments9 Minutes

Balancing Your Security Initiatives With Industry Compliance Requirements

Managing a business today comes with a number of daily battles that need to be fought. Resources…

0 Comments11 Minutes

Best plugins to enhance the customer shopping experience

Customer experience is a key part of every online store. A good experience helps customers find…

0 Comments7 Minutes

AI Content Generating Tools: Is It A Collaboration or Competition For Content Creators?

Artificial Intelligence (AI) has created waves in content creation in business verticals. From…

0 Comments13 Minutes

How to boost user engagement and conversion in WooCommerce?

One thing that is not changing today or in the coming future is the impact user engagement has on…

0 Comments9 Minutes

10 Proven Digital Marketing Strategies to Skyrocket Your ROI in 2025

Why do some companies have a more robust online presence than others? Marketers know very well…

0 Comments12 Minutes

Why Is Woocommerce Suitable For Small Businesses?

Are you finding yourself more confused than usual when choosing your online business’s platform?…

0 Comments8 Minutes