Best Marketing Metrics to Track for Digital Marketing Success in 2021

What is the difference between metrics and KPIs?

A metric is something that you can count, such as the number of users, events, or transactions. It’s just a number, and how you interpret that number is up to you.

Quick Links

A KPI is a key performance indicator, which is usually measured in percentage and has a certain norm. For instance, by comparing your actual KPI to the market average, you can draw a conclusion from the effectiveness of your business.

KPIs

- Help managers make decisions

- Included in goals and objectives

- Lead to insights and influence over the company’s future actions

- Can develop and change as time passes

Metrics

- are tracked by ordinary marketers

- are measured by ex post facto

- help analyze the past, but do not influence the future

- are static and do not change after calculation

Why are these numbers so important?

You can’t say for sure if your marketing efforts are effective until you look at the numbers. If sales are up, great! But is it due to your marketing department’s performance and how does it affect your company’s costs? KPIs can help you to determine key growth and areas of risk. Numbers don’t lie, and with the right calculations, nothing escapes the analyst’s attention.

Before we get to the formulas, here are three important things to remember:

- The more accurate your data, the better decisions you make based on it. Therefore, check the data you collect carefully, minimizing the human factor.

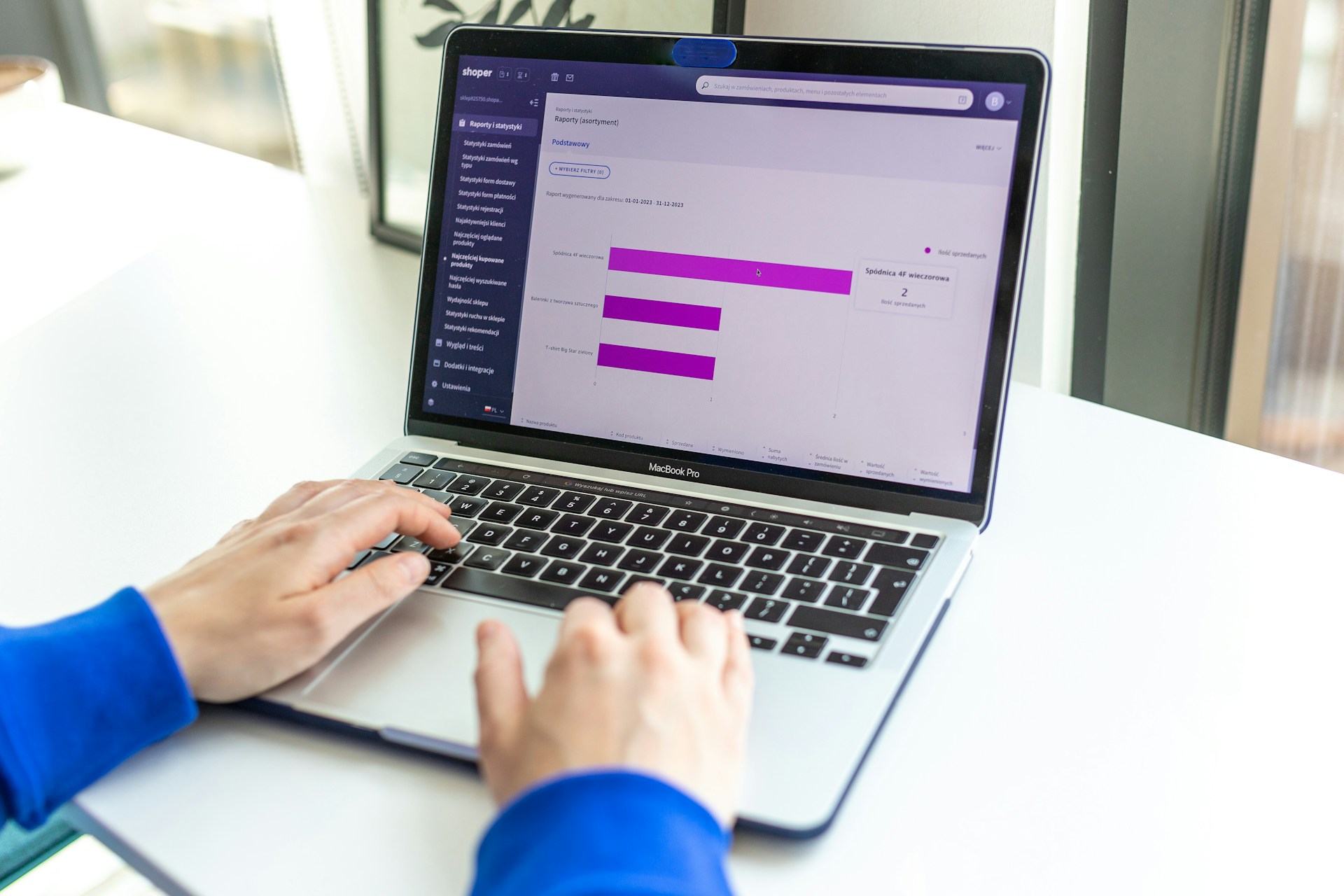

- If you’re a novice marketer, use Google Analytics to collect and process online data, create custom reports, and broaden your audience.

- Once you have a lot of data, boost your skills to avoid sampling in Google Analytics

Marketing and sales performance metrics

Digital marketing now covers almost all business areas. Even insurance companies are no exception. They adjusting their business to an online format and actively using marketing metrics. If you want to see how metrics of Online Shopping Travel Insurance work, click here. Vacation insurance is an example of a business that shows how the best marketing metrics help to track for digital marketing success in 2021.

What’s going on with sales in your business? Is your website effective enough? Has the marketing department’s efforts over the past few months paid off? Find the answers to these questions with key marketing and sales metrics and KPIs.

Conversion rate (CR)

The conversion rate is the percentage of users who complete the desired action. For example, you concluded a purchase, downloaded an app, filled in a contact form, etc. The following offers one of the simplest, but no less important metrics:

CR = (Conversions / Total Visits) x 100

Example: If last month your site had 70,008 visitors and 5,620 conversions last month. The conversion rate was the following:

CR = (5,620 / 70,008) x 100

CR = (0.0802) x 100

Conversion Rate =8.02%

If you’ve set up Goals in Google Analytics, you can see the total number of conversions and CR in the Conversion > Goals > Overview report.

Click-through rate (CTR).

This metric shows what percentage of users who saw the banner (button or link) clicked on it.

CTR = (Clicks/Impressions) x 100

Clicks – number of people who clicked the ad

Impressions – number of people who saw the ad

CTR is mainly used for the assessment of the performance of PPC advertising, as well as the following three metrics.

Cost per click (CPC)

The cost per click is the sum you pay the advertising platform for each click on your ad. This indicator will help you evaluate the economic effectiveness of paid advertising campaigns.

CPC= Cost to the Advertiser / Number of Clicks

or

The cost to the advertiser = CPC x Number of clicks received

Example: You have 150 clicks on the ad and the CPC is $4. So, the total amount that you`ll get from the ad will be 4 x 150 = $600, 00

Google Ads shows this information on auctions for your keywords. If you link your Ads and Google Analytics accounts, you can see the price per click in GA reports as well. Moreover, with OWOX BI, you can import costs from other advertising services into Google Analytics and compare CPC and other metrics for all of your campaigns in one report.

Cost per action (CPA)

The cost per action is the sum you pay the advertising platform when a user performs a desired action. It’s up to you to decide which action to consider it desired. It can be Opt-in Emails, a request for a callback, register for a webinar, etc.

CPA = Total earning from an ad campaign/ Total number of actions taken

This simple metric is the basis for CPA marketing, where you pay for every conversion that an affiliate source brings in. The pitfall of this method is that dishonest affiliate partners may try to cheat you.

Cost per Lead (CPL)

This indicator is even more interesting than the previous one. It differs in the fact that you pay for the contact information of a person potentially interested in your offer.

CPL = Customer acquisition costs per month/Leads per month

This metric will show you if your customer acquisition efforts are within budget or you’re spending too much. Bear in mind that a leader is not a ready-made customer or even a loyal user, but that person could easily become one.

Customer acquisition cost (CAC)

CAC is the sum you spend on average to attract each new customer. It includes advertising costs, marketing department salaries, software costs, designers, etc.

CAC = (Cost of sales & Marketing)/New customers acquired

Example: You spend $40,000 to acquire 1200 customers, your CAC is $33.

CAC = ($40,000 spent) / (1200 customers) = $33 per customer

Calculating how much you spend only on customer acquisition can be difficult, but it’s worth it. Therefore, you can see the bottlenecks in your customer funnel.

Cart Abandonment Rate (CAR)

CAR is the percentage of users who have added an item to a cart and left it without placing an order. It can happen for various reasons: something distracted the person, they found the same item at a lower price, or put off the buying until payday, etc.

CAR = (Tier 1 Capital + Tier 2 Capital) / Risk weighted assets

If you have a checkout goal set up in Google Analytics, you’ll be able to track the number of users who left the cart in the Conversions – Goals – Sequence Visualization report:

Return on Ad Spend (ROAS)

One of the most important metrics for measuring online marketing efficiency. ROAS is the profit your company makes for every dollar you spend on advertising.

ROAS = Revenue/Advertising costs

Comparing this KPI to all campaigns, you can easily see the difference between effective and unprofitable ads. If ROAS is higher than 100%, the campaign is successful, otherwise, you are spending more than you are earning.

Return on Investment (ROI)

ROI or ROMI (for marketing) is the king of all KPIs, even those that are far from analytics. It is a ratio that shows how profitable or unprofitable your business is in the light of investments you make in it.

ROI = (Total ad Revenue – Total ad campaign cost) / Total ad campaign cost

Example: Your company spent $500 on an ad campaign and earned a return of $1500 as the revenue. Then, the ROI = (1500 – 500) / 500 = 2. This is equal to 200% of the cost. Or for every $1 spent on the campaign, the company earned $2 in return.

Despite ROI and ROAS are similar, it is essential not to confuse these metrics, as it can lead to grave mistakes. For instance, ROI of 100% means that you earned twice as much as you spent. A ROAS of 100% means that you have made zero.

The average revenue per user/client (ARPU/ARPC)

A metric that shows how much money each user or paying customer brings you over a certain period.

ARPU = Total (monthly or yearly) revenue / Total number of customers in that duration

Calculating your ARPU, you’ll be able to figure out what your site traffic needs to be so that you can make your planned income. When you plan to increase prices, check your revenue per user before and after. If the number of users hasn’t changed significantly during this time and your ARPU has dropped, then a rise in price wasn’t a good idea.

CAC Payback Period

This number is a measure of how long it will take you to get your money back after you win one customer. CAC Payback Period is especially vital for SaaS businesses with complex funnels and long sales periods.

CAC Payback Period = CAC / MRR – ACS

This can also be MRR * Recurring Gross Margin % rather than ACS.

Monthly Recurring Revenue (MRR)

This metric is also relevant for SaaS projects that sell their services on a subscription basis. MRR helps companies forecast income and adjust their sales plans. To calculate MRR, you can simply add up the monthly payments of all customers or use the formula:

MRR = Average revenue per account x Total number of accounts in that month

Customer Churn Rate (Churn Rate)

This is the percentage of customers or subscribers who stop being your customers during a certain period.

(Lost Customers / Total Customers at the Start of Time Period) x 100

Example: If your company had 300 customers at the beginning of the month and lost 20 customers by the end, you would divide 20 by 300. The answer is 0.06. Then multiply 0.06 by 100, resulting in a 6% monthly churn rate.

It’s important to track this metric if your primary income depends on repeat customers. A high Churn Rate can show that you have a problem with your product or that your prices are too high compared to your competitors.

Revenue churn (also known as “MRR churn rate”)

This metric shows how much money your company is losing due to customer churn.

(MRR beginning of month – MRR end of month) – MRR in upgrades during month) / MRR beginning of month

Example: If your company had $500,000 MRR at the beginning of the month, $450,000 MRR at the end of the month, and $65,000 MRR in upgrades that month from existing customers, its revenue churn rate would be -3%.

Serviceable Obtainable Market (SOM)

This indicator tells you how your company’s market position compares to your competitors.

SOM = (Total Sales of the Company / Total Sales of the Market) × 100

Tracking your market share, you can understand why you’re deviating from your sales plan and set the right goals for growth.

Share of wallet (SOW)

A metric that helps you understand how loyal your customer is. The SOW is the percentage of money spent on your company from the total sum a customer spends on products in the same category. You can obtain this data by means of market research or focus groups.

SOW = (Costs spent on your goods / Total costs spent on this category of goods) × 100

Example: Carl spent $20 on your handmade soap in May and bought $120 worth of soap for the month on the whole. In that case, your wallet share would be 16.6% (20/120 × 100%).

Customer Retention Rate (CRR)

How often do users return to your site? Or do they make a purchase and leave forever? It will more costly to attract new customers than it does to “reactivate” existing but temporarily inactive customers. That’s why it’s important to track customer retention rates, and the best way to do this is through cohort analysis.

[(Customers at the end of the time period – New customers gained within the time period) / Customers at the beginning of the time period] × 100

The ideal customer retention rate is 100%. This means that customers are loyal and stay with you for some time. If the CRR decreases, pay more attention to customer service. It’s worth trying to keep this KPI high.

Customer Lifetime Value (CLV or LTV)

LTV is the profit you get from the customer for all the time you work with him. This figure can be actual (the sum of all profits from buyings made by the customer) or forecasted (the total income you expect to receive from this customer). The simplest formula for calculating a customer’s lifetime value is as follows:

LTV = ARPU (average monthly recurring revenue per user) × Customer Lifetime

Why is LTV so important? For the reason that the longer people stay with your company, the higher your income will be.

Summary

When you start looking into marketing metrics, it’s easy to get confused. A prodigious amount of digital marketing data available is marvellous. The marketing metrics and KPIs that we reviewed in this article are just the tops of the iceberg. However, they are a must for anyone who does not want to repeat the fate of the Titanic in the open sea of business.

Author Bio

Isabelle Jordan is a business and marketing journalist at Ekta Traveling insurance company. She writes for different news portals and thematic blogs that helps her stay at the heart of the travel and insurance news. Such work gives her the opportunity to write articles on the most relevant topics of today.

How to Use AI-Powered SEO Tools for WordPress eCommerce

SEO is a critical factor in the success of any e-commerce WordPress store. As competition…

0 Comments11 Minutes

Why Short-Form Videos Are the Future of Content Marketing

Your Instagram customers spend over 50% of their time watching short-form videos and reels. Rather…

0 Comments12 Minutes

The Role of Digital Marketing in Business Growth

Online marketing touches every aspect of a business, whether it is initiating the idea or for an…

0 Comments3 Minutes

AI Meets Authenticity: Balancing Automation and Human Touch in Content Marketing

Is your brand starting to sound like a robot? In a world where algorithms write faster than any…

0 Comments8 Minutes

Essential Tools for Enhancing Web Design and UX Hosting

Have you ever visited a website that felt slow, clunky, or confusing? A website that is poorly…

0 Comments11 Minutes

How a Mini Cart Transformed My Store’s Shopping Experience

Okay, real talk—running an online store is hard. You think you’ve got everything figured out, you…

0 Comments9 Minutes

Balancing Your Security Initiatives With Industry Compliance Requirements

Managing a business today comes with a number of daily battles that need to be fought. Resources…

0 Comments11 Minutes

Best plugins to enhance the customer shopping experience

Customer experience is a key part of every online store. A good experience helps customers find…

0 Comments7 Minutes